One frequent question to ask about your finances is, “What’s changed, and how do those changes affect me?” Your financial advisor can help you through the specific updates that impact you, showing you how to pivot as a result of them. To get started, here are three high-level changes that may influence your retirement planning in 2025.

1. Changes to retirement saving limits

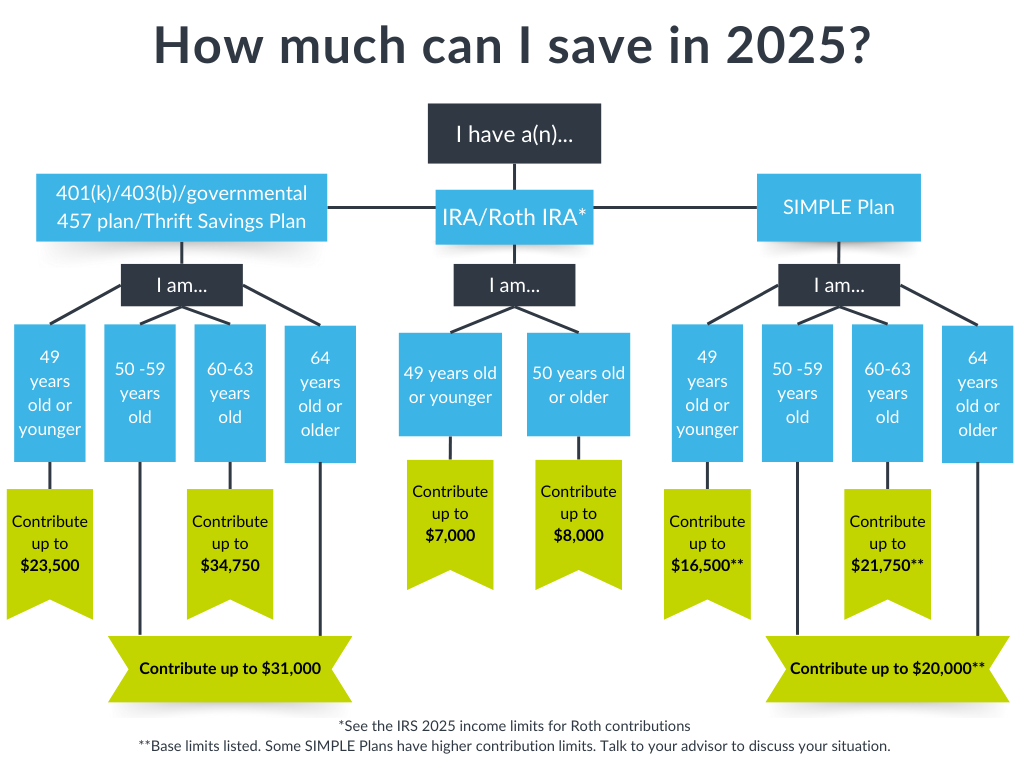

An annual change we keep an eye on is how much money you can tuck away in different retirement-saving vehicles, such as your 401(k) or IRA. Of course, change isn’t a given. For example, there was a $0 increase in the IRA limits from 2024 to 2025, including the catch-up contribution limit.1

The IRS is a helpful resource, but it is easy to get confused, as things vary based on where you are saving money and how old you are. The chart below can serve as a starting point.1

This chart does not cover all retirement-saving vehicles and specific circumstances that may affect how much you can save. For example, you may notice a few notes in the fine print regarding exceptions or variances. With retirement savings, things aren’t always as cut and dry as we’d like. Even the IRS uses phrases such as “generally applies.”1 As such, we recommend speaking to an advisor if you have questions about your situation.

2. Changes to the Required Minimum Distribution (RMD) starting age

Don’t be alarmed — this is not an announcement about a new RMD change for 2025! Instead, we’re resurfacing previous updates that still apply this year.

Per the shift established by the Secure Act 2.0, those of you born in 1953 and turning 72 this year do not need to worry about your RMDs (unless you started taking them previously.)2,3

However, if you were born in 1952 and are turning 73 in 2025, this is the first year your RMD applies. No urgent action is required, but be prepared to meet this obligation by April of next year (at the latest).2,3

For a basic RMD refresher, check out our most recent breakdown: “RMDs 101 – How Does a Required Minimum Distribution Work?”

As always, if you are curious about exceptions or unique situations, such as if you have not retired by age 73 and have a 401(k), ask a professional.2,3

3. Changes to Social Security income

You may have heard murmurs of something happening with Social Security, but perhaps you aren’t sure what it is and if it matters to you or your loved ones.

According to the Social Security Administration, the essence of the change, coming through the Social Security Fairness Act, is this:

“The [Social Security Fairness] Acts ends the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These provisions reduced or eliminated the Social Security benefits of over 3.2 million people who receive a pension based on work that was not covered by Social Security (a ‘non-covered’ pension) because they did not pay Social Security taxes. This law increases Social Security benefits for certain types of workers…” 4

In short, the government is backstepping on some Social Security cuts, returning and reinstating benefits to those affected under two circumstances – the Windfall Elimination Provision and the Government Pension Offset.

If you are involved in this update, you might not see the fruits of this retirement planning change in 2025, but be mindful of it as you adjust and live out your financial plan this year.4 In addition, a good next step you can take in 2025 is to complete some Social Security admin, namely, confirming your contact and banking information.4

If you have questions regarding changes to retirement planning in 2025, reach out using the form below.

Contributing Sources:

- Internal Revenue Service. (2024, November 12). 401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000. IRS.gov. https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000#:~:text=Highlights%20of%20changes%20for%202025,to%20an%20IRA%20remains%20%247%2C000.

- Internal Revenue Service. (2024, November 12). IRS reminds those aged 73 and older to make required withdrawals from IRAs and retirement plans by Dec. 31; notes changes in the law for 2023. IRS.gov. https://www.irs.gov/newsroom/irs-reminds-those-aged-73-and-older-to-make-required-withdrawals-from-iras-and-retirement-plans-by-dec-31-notes-changes-in-the-law-for-2023

- Internal Revenue Service. (2025, January 29). Retirement plan and IRA required minimum distributions FAQs. IRS.gov. https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs#:~:text=Required%20minimum%20distributions%20(RMDs)%20are,when%20you%20reach%20age%2073

- Social Security Administration. (2025, January 24). Social Security Fairness Act: Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) update. SSA.gov. https://www.ssa.gov/benefits/retirement/social-security-fairness-act.html?tl=0