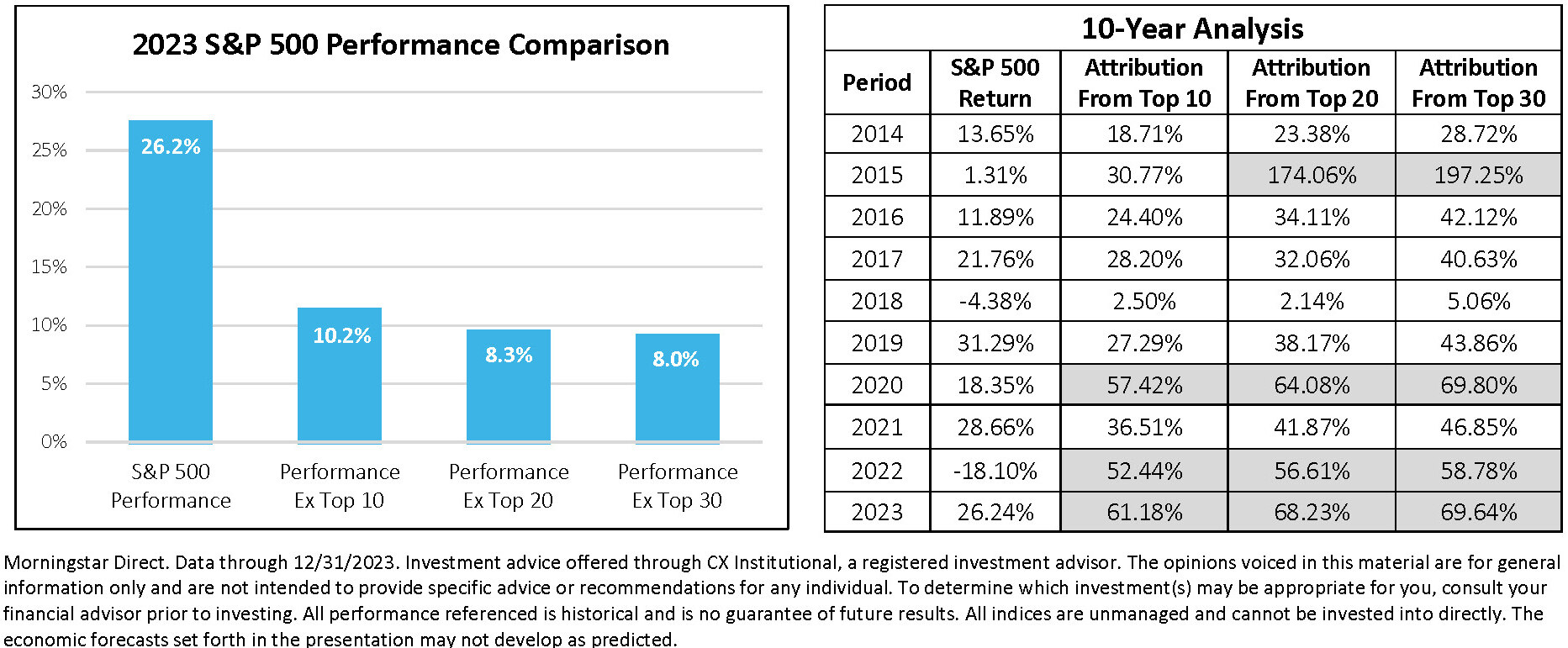

The pursuit of excess investment returns in 2023 was predominantly determined by having substantial investments in the top 10 companies of the S&P 500 Index, as measured by market capitalization. Forgoing an oversized commitment to those 10 companies would entail a significant – and appropriate – underperformance compared to the S&P 500’s overall return. Upon closer examination of the S&P 500’s performance, it becomes apparent that a substantial 61% of 2023’s gains can be attributed to these specific companies. To illustrate this differently, if we were to exclude the top 10 names from the S&P 500’s return of 26.2% in 2023, the performance would drop to 10.2%. While the return dominance by the top 10 companies within the S&P 500 is not a new phenomenon to 2023, the current overconcentration in performance appears to be pushing the boundaries in an unprecedented manner. The S&P 500, with its continually ascending valuation profile, stands as a testament to this trend. However, it is crucial to recognize that this concentration does not guarantee an unbroken streak of outperformance for the upcoming year. Chasing performance from the top names may lead to an unnecessary and potentially destructive risk profile.

For further clarity, it is important to understand the composition of the S&P 500. The index, a widely tracked benchmark, exhibits a significant concentration, with an outsized 46.9% of its composition represented by the largest 30 companies based on market capitalization. This substantial concentration underscores the inherent risk of blindly chasing performance, as a well-diversified portfolio should not closely track an index so heavily skewed towards a handful of mega caps. Considering this, a prudent investment approach necessitates a careful evaluation of the risks associated with pursuing concentrated performance, along with a thoughtful consideration of diversification across geographies, style class, and market capitalization to implement a risk-centric approach to investment management.