Myths and misinformation around Social Security claiming strategies can cause hardworking Americans to miss out on some of their benefits.

Working with an expert is one of the best ways to ensure you have the most accurate information when building your financial plan.

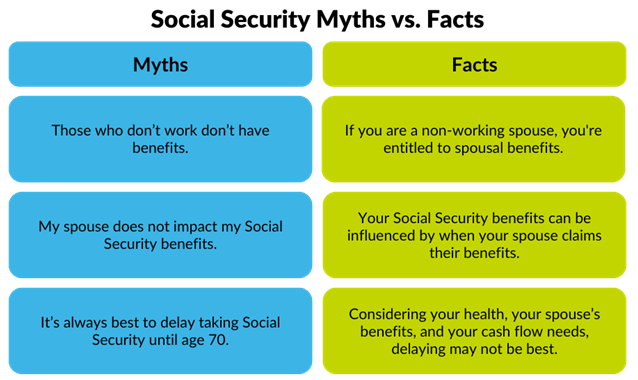

Here are three common Social Security myths we can debunk today:

Myth #1: “I don’t have benefits because I have not worked.”

The Myth of the Non-Working Spouse: Even if you have not worked, if you are a non-working spouse, you are entitled to spousal benefits.

This means you are eligible to receive 50% of whatever your working spouse’s benefits are at full retirement age.

Myth #2: “My spouse’s Social Security decisions don’t impact me.”

The Myth of a Spouse’s Social Security: Your Social Security benefits can be influenced by when your spouse claims their benefits.

If your spouse claims early, it may reduce both your spousal and survivor benefits.

An expert can help you strategize how you and your spouse’s benefits work together.

Myth #3: “Delaying is always best.”

The Myth of Delaying Social Security: While people often discuss and advise delaying Social Security until age 70, it may not be the best strategy for you.

Our favorite answer in these situations is, “It depends.” Whether or not delaying is right for you will always depend on your personal circumstances and your overall financial plan.

Think about:

- Your Health: If you have health concerns or a shorter life expectancy due to family history, it may be beneficial to claim early.

- Your Spouse’s Benefits: As mentioned previously, for married couples, strategic claiming can optimize household benefits. This might involve the lower earner claiming at full retirement age while the higher earner delays until age 70.

- Your Cash Flow Needs in Retirement: If you delay Social Security until age 70, you may need to tap into pre-tax retirement accounts, such as 401(k)s and IRAs. If you do this, you will pay taxes on the money you withdraw. Depending on how those taxes impact you, your advisor may decide claiming Social Security earlier is the better option. Our planning approach integrates all income sources and their tax implications so we can optimize your Social Security claiming in a way that works for you.

Ultimately, generalized advice contains many myths and misinformation. Working with someone who understands you and your overall financial plan leads to a better outcome.

If you’d like to talk to an advisor about optimizing your Social Security benefits, reach out to our team at [email protected] or fill out the form below.

To debunk other financial planning myths, check out “5 Financial Rules of Thumb: When They Work and When They Don’t.”