Concentration of Returns in the S&P 500

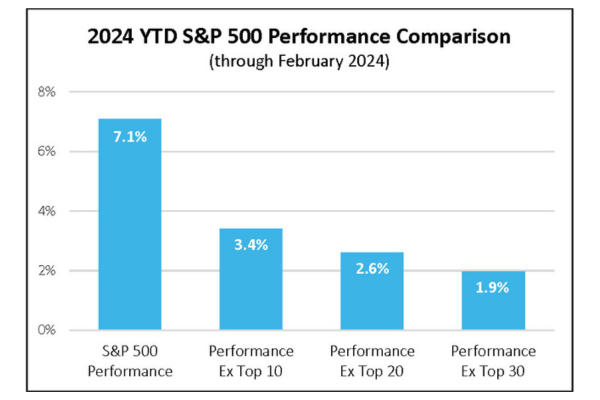

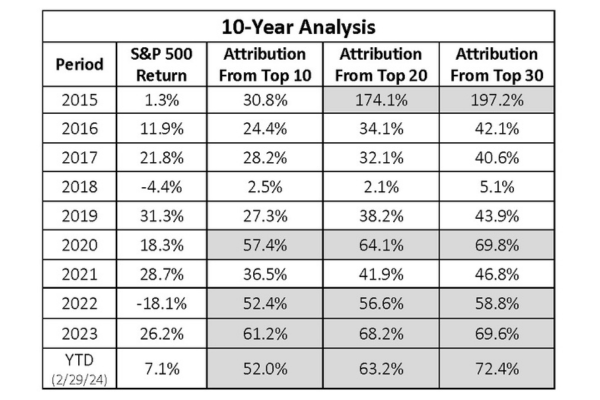

For further clarity, it is important to understand the composition of the S&P 500. The index, a widely tracked benchmark, exhibits a significant concentration, with an outsized 48.7% of its composition represented by the largest 30 companies based on market capitalization. This substantial concentration underscores the inherent risk of blindly chasing performance, as a well-diversified portfolio should not closely track an index so heavily skewed towards a handful of mega caps. Considering this, a prudent investment approach necessitates a careful evaluation of the risks associated with pursuing concentrated performance, along with a thoughtful consideration of diversification across geographies, style class, and market capitalization to implement a risk-centric approach to investment management.

Bloomberg. Data through 2/29/2024. Investment advice offered through CX Institutional, a registered investment advisor. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. The economic forecasts set forth in the presentation may not develop as predicted.

To review our 2024 Outlook, click here.