Positioning and Outlook

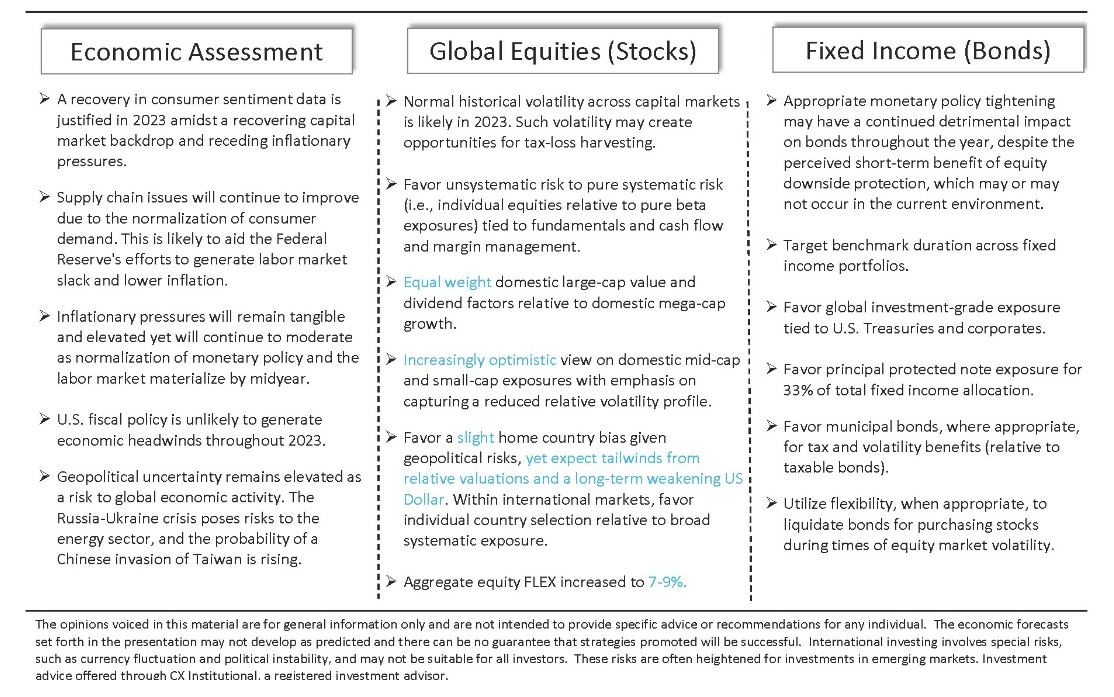

We remain constructive on global equity markets and favor such exposure relative to bonds. While the U.S. economy is likely to experience a mild-to-normal recession in 2024, the notion of which has been highly anticipated within equity markets, we remain convicted of a soft landing given labor market strength, a fiscally healthy consumer base, and normalizing inflationary data.

Managing emotions and practicing discipline may likely prove to be two of the most important investment management tools for the year.

Global Core Allocations

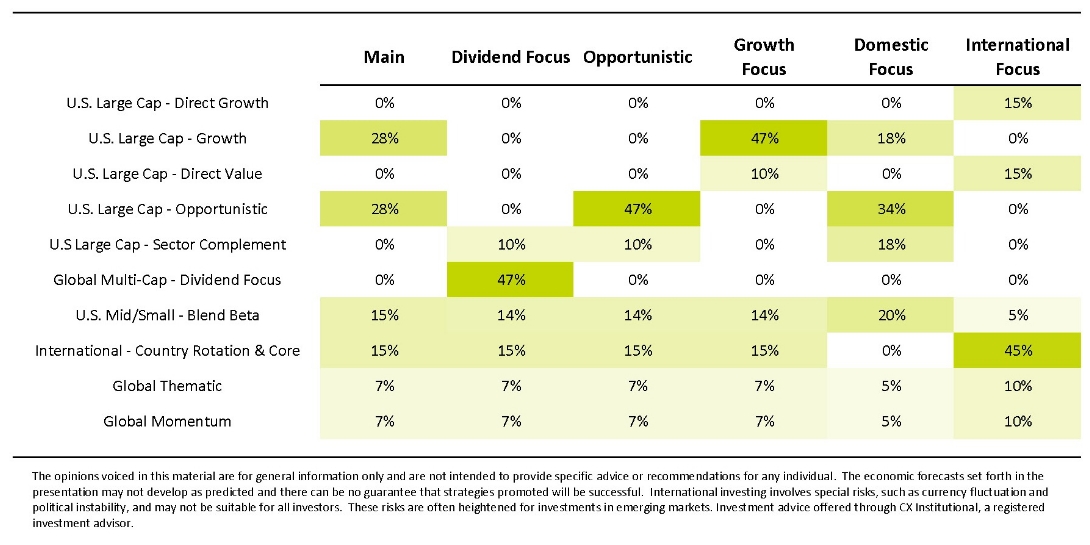

Credent Wealth Management oversees six Global Core Allocations, which exhibit a multi-strategy approach that has been selected by the Investment Policy Committee. The goal of our unique multi-strategy allocations attempts to derive positive risk-adjusted returns over 3-5-year rolling periods while at the same time attempting to control for short-term excessive market volatility. The structure of our allocations is rebalanced quarterly.

‘Global Core – Main’ encompasses the targeted recommendation of the Investment Policy Committee. It features objective adjustments to factor exposures, tactical and strategic style class weighting, and a more intentional approach to global diversification. It is structured predominantly with individual equities targeted as the best ideas within each asset class.

Five additional allocations are managed toward specific factor tilts, including dividends, value, growth, domestic, and international exposures. The table below highlights the current positioning within all Global Core Allocations and emphasizes that while U.S. large-cap exposures utilize differing strategies, most allocations include exposure to mid/small caps, international equities, thematic, and momentum strategies. Such style class overlap exposure provides for a contingency risk buffer during times of volatility.

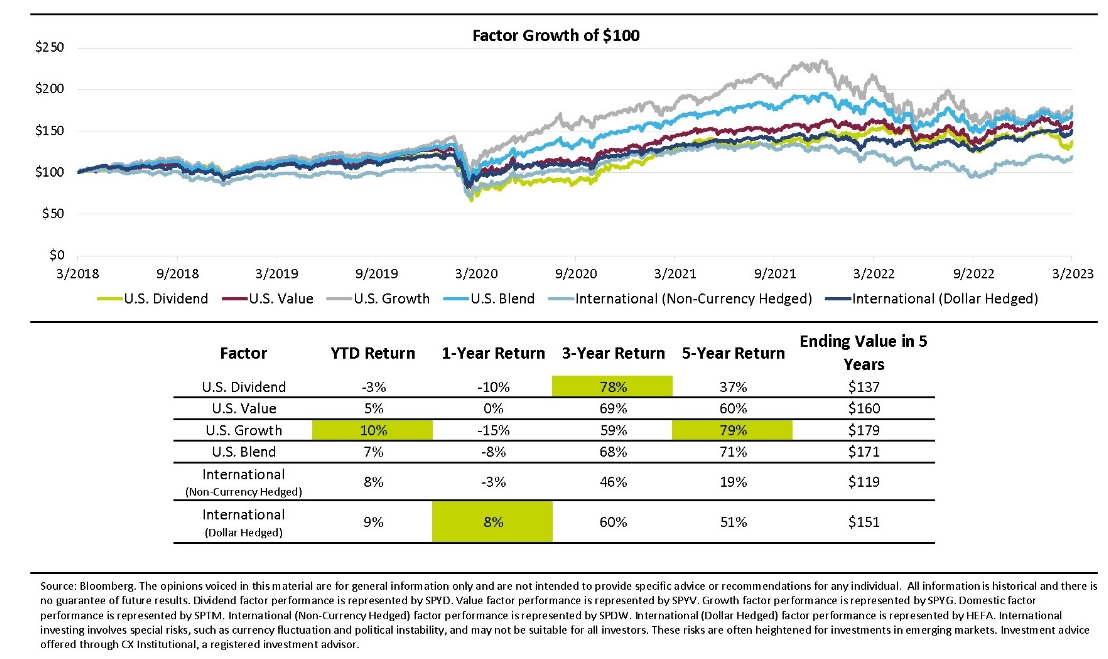

Factor Performance

Factor investing is a strategy that selects securities based on factors that are associated with the potential for excess return and reduced risk. In addition to the ‘Global Core – Main’ allocation, Credent Wealth Management offers five Global Core Allocations that are managed toward dividend, value, growth, domestic, and international factors.

Credent Wealth Management believes that all investment strategies work some of the time and that no investment strategy works all of the time. The same is true for factor investing. Our unique Unified Managed Account platform allows for the pairing of multiple Global Core Allocations within a household in an attempt to maximize long-term risk-adjusted total return.

Investment advice offered through CX Institutional, a registered investment advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in the presentation may not develop as predicted.

All data is sourced from Bloomberg, through the release of monthly figures from the U.S. Bureau of Labor Statistics or from the Federal Reserve and any of its affiliated regional location.