Chart Content

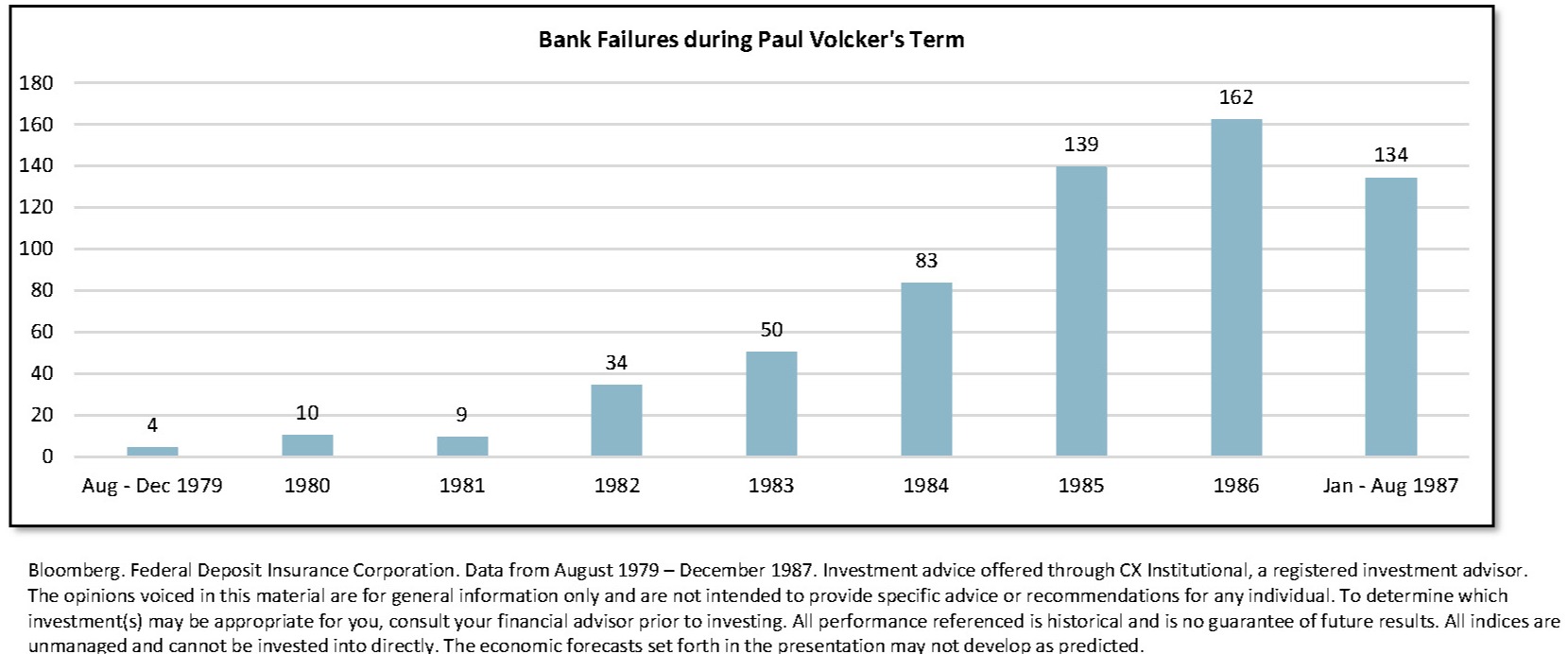

Number of United States bank failures during former Federal Reserve Chair Paul Volcker’s term.

Chart Significance

Given inflation’s sharp and persistent rise since the COVID-19 pandemic, the media has continuously compared current Federal Reserve Chairman Jerome Powell to former Federal Reserve Chairman Paul Volcker.

Mr. Volcker, who led the Federal Reserve from August 1979 through August 1987, tackled soaring inflation, which peaked at 14.8% in March of 1980, by raising the federal funds rate to 20% just eight months into his first term.

During his tenure, 625 banks failed, with an additional 310 needing assistance from the Federal Deposit Insurance Corporation (FDIC). His hawkish monetary policies broke the persistent inflation experienced in the early to mid-1980s, with inflation falling to 4.3% at the end of his term.

Potential Forward-Looking Implications

Paul Volcker’s term has taught us that the stock market and the economy are not the same. Despite 625 bank failures, average inflation of 6.2%, soaring mortgage and interest rates, and stubbornly high unemployment, the S&P 500 Total Return Index gained over 245% over 8.5 years (August 1979 – December 1987).

Such a return profile amounts to nearly 16% annualized and is inclusive of Black Monday, which refers to the sudden global market collapse that occurred on Monday, October 19th, 1987.

This period showcases that the status of the macroeconomic environment should never be a standalone decision factor in gauging the potential for future stock market returns. History provides us with a working example of why this is true.

Investment advice offered through CX Institutional, a registered investment advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in the presentation may not develop as predicted.

All data is sourced from Bloomberg, through the release of monthly figures from the U.S. Bureau of Labor Statistics or from the Federal Reserve and any of its affiliated regional location.