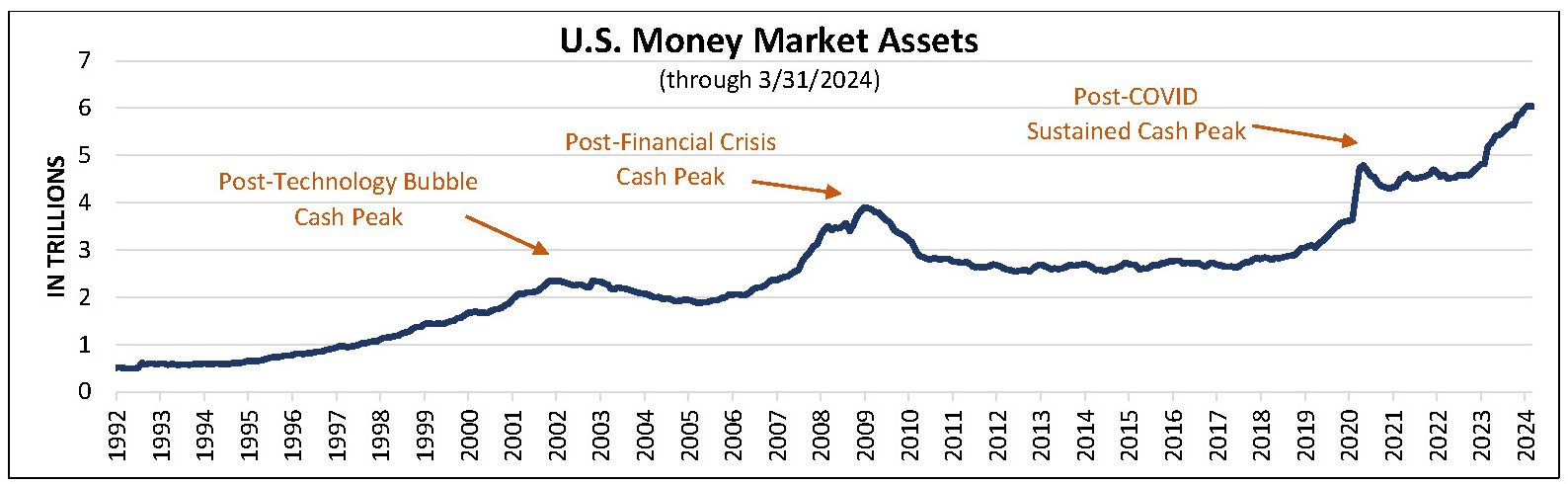

Volatility across capital markets is often a sign of cash exiting or entering a specific asset class, which can be defined as exposure to stocks, bonds, commodities, or any other investment that carries a reasonable liquidity profile. Measuring the level of cash that investors are sitting on has often provided an actionable perspective as to the potential medium-term outlook for capital markets. It has also provided an understanding of why cash levels may have risen (or declined) relative to macroeconomic and geopolitical events. The cash analysis conversation becomes paramount in today’s environment because U.S. investors are currently sitting at record-high cash levels (as measured by money market funds). We believe this to be an immense benefit for those investors willing to sustain or increase their level of equity market participation.

The COVID-induced bear market of 2020 was clearly a catalyst for short-term fear, and we can observe an immediate impact with an increase in aggregate cash levels. What’s most interesting, however, is that the notion of short-term fear remained highly intact for most investors post-COVID and likely resulted in many investors forgoing sizeable equity market gains in 2021 and 2023. As we look ahead to the next 12-24 months, we cannot make predictions on the extent of market movements, but we feel confident in saying that the current record-high cash levels are not likely to remain as is. The cash may be deployed across numerous asset classes, and stocks likely stand to benefit the most (in our view). This is not only because stocks have historically provided the best protection against inflation but because the current backdrop of consumers remains fiscally healthy, with additional declines in inflation over the coming months likely to lift real incomes, boosting consumption in the process.

We believe the information provided in the chart below represents a contrarian indicator the likes of which we haven’t observed since the COVID bear-market lows of March 2020. Investors will deploy cash at some point in the future, and missing that inflection point may result in a detrimental outcome to your investment portfolio.