Blog

The future you want, the money to do it.

Education is a key component of our planning and investment process. We share our expertise with you through our blog so that you can have a deeper understanding of your finances and the decisions surrounding them.

The Latest From Our Blog

2 Ways Inflation Impacts Retirement + What You Can Do

Take steps to keep inflation from impacting today’s savings rates and tomorrow’s retirement comfort. Inflation, the silent force shaping our economic landscape, often creeps into our lives unnoticed until its effects become palpable. Its impact on retirement planning, in particular, underscores its double-edged nature. How inflation works At...

The Economic Data Disconnect – Can We Rely on Economic Forecasts?

Economists release a great deal of data analyzing and projecting expectations for the market and economy. This information can be insightful, but should we rely on these indicators? For about the past 3-4 years, consumer participation in economic surveys has dwindled. Therefore, the quality of economists’ data is starting to weaken, and there...

3 Changes to Retirement Planning in 2024

The SECURE 2.0 Act has been in effect for over a year after being signed into law on December 29th, 2022. It includes several retirement provisions impacting Required Minimum Distributions and contribution limits for high-income earners. To learn about these earlier changes, check out our previous video, “3 Important Financial Planning Changes:...

5 Reasons to Supplement Your Social Security Income

When it comes to planning for retirement, Social Security benefits have traditionally been viewed as a safety net for many individuals. However, in recent years, there has been growing concern about the long-term viability and sustainability of the Social Security system. As a result, it is becoming increasingly important for individuals to...

Our View of 2024: January Update

Increasingly OptimisticConsumer health will dominate headlines in 2024 as the eventual recession becomes a reality. The onset of a recession is a lagging indicator and represents a normalized shift in the business cycle, one that has occurred every 6.5 years since WWII (on average). We are emphasizing a soft landing, which indicates slowing...

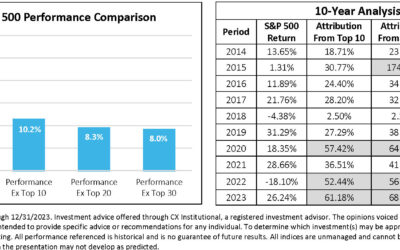

Concentration of Returns in the S&P 500

The pursuit of excess investment returns in 2023 was predominantly determined by having substantial investments in the top 10 companies of the S&P 500 Index, as measured by market capitalization. Forgoing an oversized commitment to those 10 companies would entail a significant – and appropriate – underperformance compared to the S&P 500's...

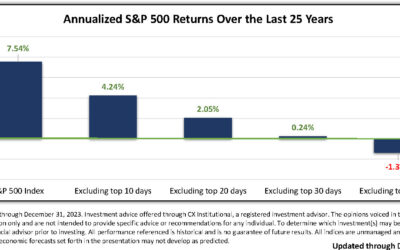

Time in the Market

Chart Content: Annualized S&P 500 Index returns over the past 25 years compared to annualized S&P 500 Index returns over the same time frame when missing the top 10, 20, 30, and 40 days in the market. Chart Significance: Missing the best-performing days in the market over the past 25 years resulted in a weaker annualized return compared...

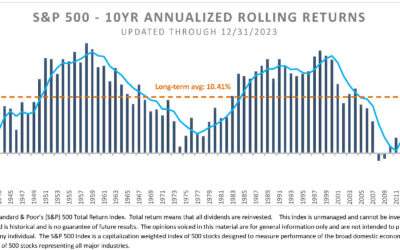

10-Year Annualized Rolling Returns

The chart below is a continuation of our 2014 series and tracks the 10-year rolling annualized returns of the Standard & Poor’s (S&P) 500 Index. Each year represents returns from the previous ten years, and it includes the year presented. For example, the 10-year annualized return through 2019, which is 13.55%, exhibits the annualized...

Determining a Personalized Inflation Rate

In an age of customization, is it possible to personalize your approach to inflation? Inflation is the general rise in prices and the concurrent decrease in purchasing power over a period of time. Most countries have an official inflation rate that's primarily based on the Consumer Price Index (CPI). But what if the generalized CPI doesn't...

Are HSA Contributions Tax Deductible? Answers to 11 Essential HSA Questions

If you’ve ever had questions about a Health Savings Account (HSA), you’re not alone. What are they used for? How do taxes work? Should I get one? Answering these and other questions can help you take advantage of the investment and saving options available to you. Contributing to an HSA allows you to save for medical expenses by putting...